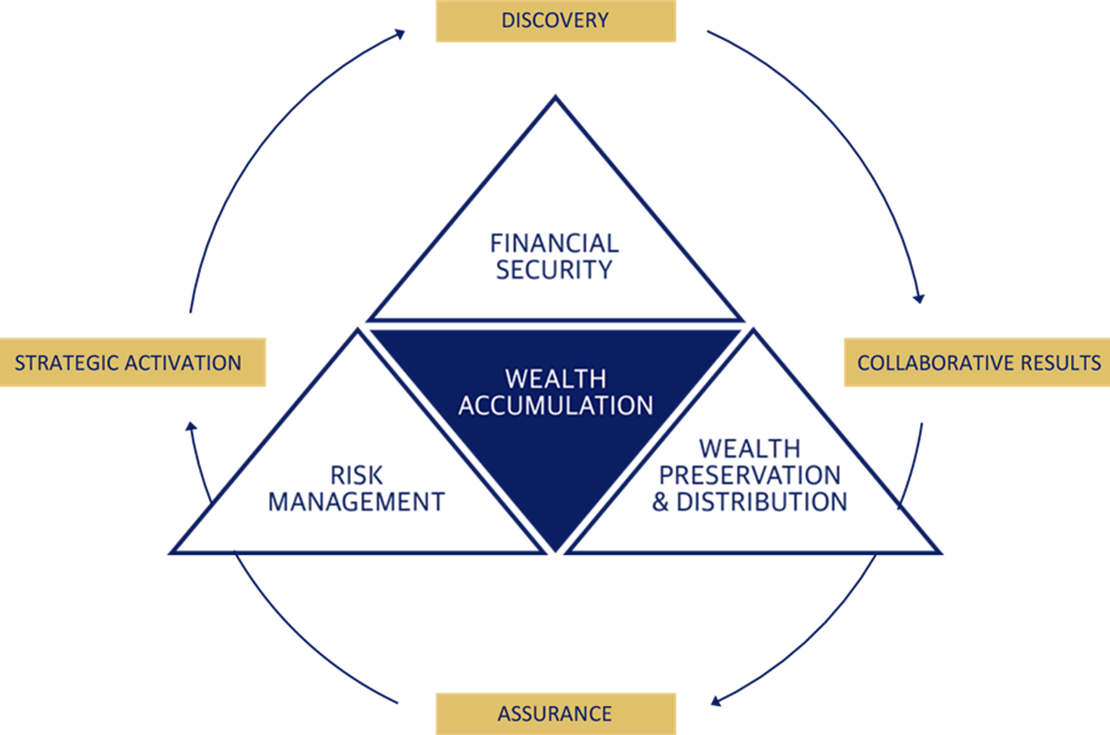

AREAS OF FOCUS

- FINANCIAL SECURITY - Achieve your most important goals and dreams at every life-stage.

- WEALTH ACCUMULATION - Make decisions free from emotion with a Personalized Investment Strategy.

- WEALTH PRESERVATION & DISTRIBUTION - Preserve and protect your wealth for your life and legacy with tax reduction strategies, trusts.

- RISK MANAGEMENT - Mitigate risk with solutions that help prepare for the unexpected.

NORTHWESTERN MUTUAL FINANCIAL REPRESENTATIVES DO NOT PROVIDE TAX OR LEGAL ADVICE. INDIVIDUALS SHOULD SEEK ADVICE BASED ON THEIR CIRCUMSTANCES FROM AN INDEPENDENT TAX OR LEGAL ADVISOR.

EXECUTING YOUR FINANCIAL PLAN

Planning that goes beyond your portfolio to protect what matters most and grow your wealth.

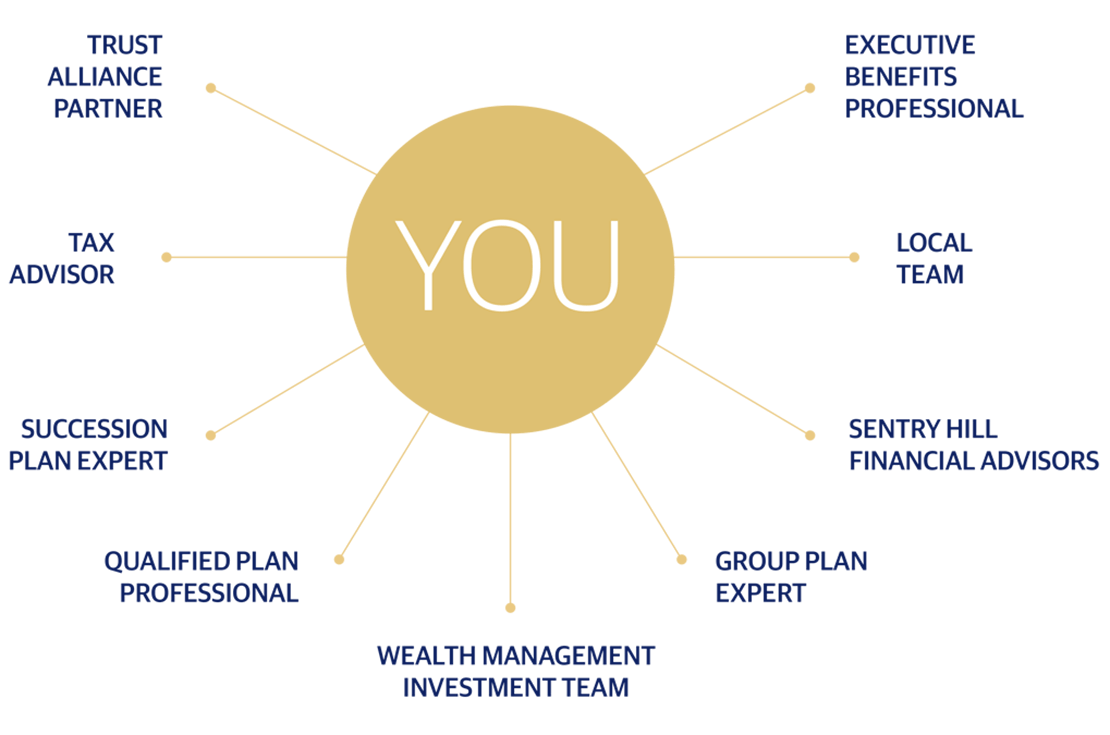

The Sentry Hill Financial Advisors team, with 150 years combined experience, helps set your plan in motion with thoughtfully integrated tools to keep you moving toward your goals.

Your extended, coordinated team in these efforts includes specialists across a spectrum of wealth management areas.

Our process never stops...

VIDEO: ACHIEVE THE FUTURE YOU ENVISION

Using a comprehensive process, we will help you build a Personalized Financial Plan that is unique to your goals and priorities, using:

- A defensive/offensive approach to financial security.

- Risk management to protect against the unexpected.

- Calculated steps designed to accumulate wealth.

- Strategies to turn your assets into predictable income in retirement and leave a legacy.

As your priorities change, we will help adjust your plan and revisit it regularly. We will help you stay focused on your goals throughout your life and approach each milestone with confidence.